INDIVIDUAL HEALTH INSURANCE

INDIVIDUAL HEALTH INSURANCE

Healthcare costs in India are rising faster than inflation. A single hospitalization can significantly impact your savings and long-term financial goals. This is why individual health insurance has become a necessity rather than a luxury. Unlike family floater policies, individual health insurance offers dedicated coverage for one person, ensuring full utilization of the sum insured without sharing benefits with others.

In this guide, you’ll learn everything about individual health insurance meaning, benefits, eligibility, coverage, costs, how to choose the right plan, and frequently asked questions written with SEO best practices for higher Google rankings.

What is individual health insurance?

Individual health insurance is a medical insurance policy that provides coverage to a single person under one policy. The entire sum insured is exclusively available to the insured individual, unlike family floater plans where coverage is shared among multiple members.

This type of policy is ideal for:

- Single individuals

- Working professionals

- Senior citizens

- People with specific medical needs

- Those who want separate coverage for each family member

How individual health insurance works?

When you purchase an individual health insurance policy, you select the sum insured, policy term, and any additional add-ons or riders based on your healthcare needs and financial goals. You may also choose a deductible, if applicable, to manage your premium costs. In case of hospitalization or eligible medical treatment, the insurer covers the expenses either through cashless treatment at network hospitals or by reimbursing the medical bills after claim submission, subject to the policy terms and conditions.

Key features of individual health insurance

1 . Dedicated sum insured

The entire coverage amount is reserved for one person and does not get reduced by claims of other family members.

2 . Lifetime renewability

Most individual health insurance plans offer lifetime renewal, ensuring continuous protection even in old age.

3 . Customizable coverage

Policyholders can choose add-ons such as critical illness cover, room rent waiver, maternity cover, or OPD benefits based on personal needs.

4 . No claim bonus

If no claim is made during the policy year, insurers increase the sum insured or provide premium discounts on renewal.

5 . Tax benefits

Premiums paid for individual health insurance qualify for tax deductions under Section 80D of the Income Tax Act.

Benefits of individual health insurance

1. Complete coverage control

Since the sum insured is not shared, you can fully utilize your coverage without worrying about exhaustion due to another family member’s claim.

2. Better risk assessment

Premiums and coverage are customized based on the individual’s age, health condition, and lifestyle, ensuring more accurate risk pricing.

3. Ideal for senior citizens

Senior citizens often benefit more from individual plans than family floaters because their medical needs are higher and require exclusive coverage.

4. Protection against medical inflation

Individual health insurance protects against rising hospitalization and treatment costs, which increase every year.

5. Financial security during emergencies

It ensures that medical emergencies do not disrupt savings, investments, or long-term financial plans.

What is covered under individual health insurance?

Individual health insurance plans are designed to cover a wide range of medical expenses, helping reduce out-of-pocket costs during both planned and emergency treatments. These policies ensure financial support across different stages of medical care, from diagnosis to recovery. However, coverage details may vary depending on the insurer and the specific policy chosen.

Most individual health insurance plans in India cover:

- Hospitalization expenses (room rent, ICU, doctor fees, nursing charges)

- Pre-hospitalization and post-hospitalization expenses

- Daycare procedures

- Ambulance charges

- Modern treatments (as per policy terms)

- Organ donor expenses

- AYUSH treatments (in many plans)

Coverage varies by insurer and policy variant, so reviewing policy wording is essential.

What is not covered?

While individual health insurance provides wide medical coverage, certain conditions and treatments are not covered under standard policy terms. Understanding these exclusions helps avoid claim rejections and ensures realistic expectations from your policy.

Common exclusions in individual health insurance include:

- Pre-existing diseases during the initial waiting period

- Cosmetic and aesthetic procedures

- Non-prescribed medicines

- Experimental or unapproved treatments

- Injuries from self-harm or illegal activities

Always check the exclusions section of the policy document before purchasing.

Individual health insurance vs family floater plan

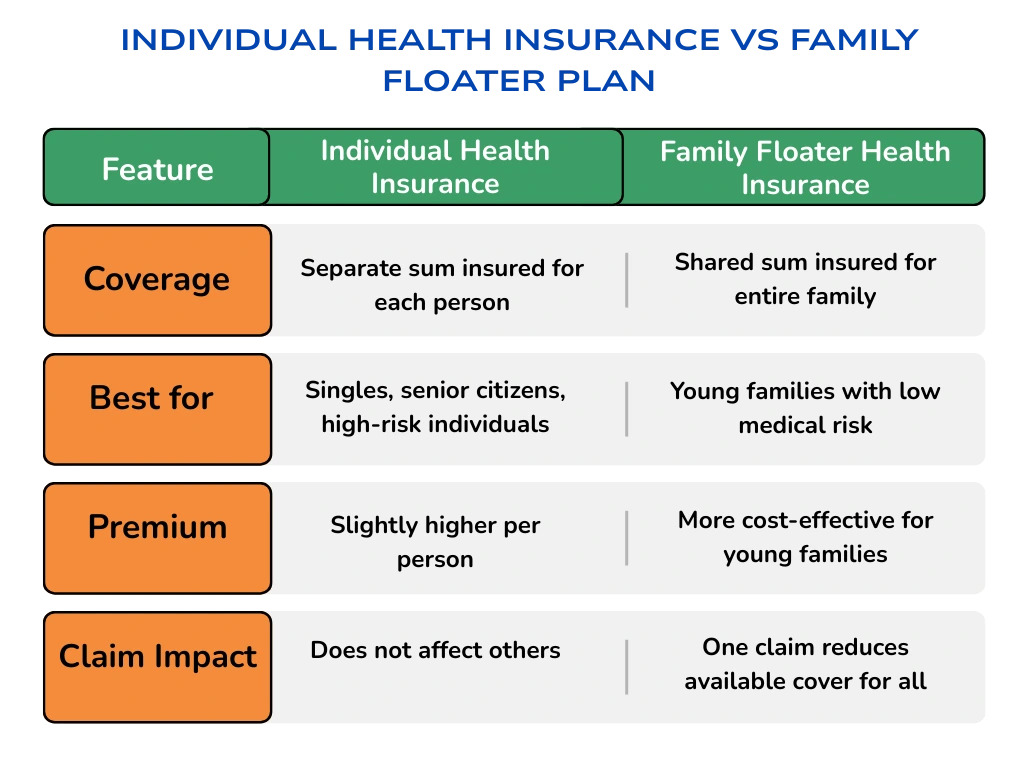

Choosing between individual health insurance and a family floater plan depends on your age, health condition, family size, and medical needs. While both options provide health coverage, the structure of benefits and usage differs significantly. Understanding these differences helps in selecting the most suitable plan for long-term financial protection.

Eligibility for individual health insurance

Eligibility criteria for individual health insurance may vary slightly between insurers, but most companies offer flexible entry and renewal options to ensure long-term medical protection. These policies are designed to provide coverage across different age groups with continued benefits over time.

Most insurers allow:

- Entry age starting from 18 years

- Maximum entry age up to 65–75 years (some plans offer lifelong entry)

- Lifetime renewability of the policy

- Coverage for children under separate child plans or family floater policies

It is advisable to check the specific eligibility terms of the chosen insurer before purchasing the policy.

How much sum insured should you choose?

Choosing the right sum insured is crucial when buying individual health insurance because it determines how much financial protection you will have during a medical emergency. The ideal coverage amount depends on factors such as your city of residence, as treatment costs are higher in metro cities, along with your lifestyle, health risks, and family medical history.

Experts generally recommend a sum insured of ₹5–10 lakh for individuals in tier-2 cities and ₹10–25 lakh for those living in metro cities. Opting for adequate coverage helps protect you against rising medical costs and ensures better financial security during major treatments or hospitalizations.

Claim process in individual health insurance

Individual health insurance policies offer flexible claim settlement options to ensure smooth access to medical treatment without financial stress. Depending on the hospital and situation, policyholders can opt for either cashless treatment or reimbursement of medical expenses. Understanding both processes helps ensure faster and hassle-free claim settlement.

Cashless claim

- Inform insurer at network hospital

- Submit pre-authorization form

- Insurer settles bills directly with hospital

Reimbursement claim

- Pay hospital bills

- Submit claim documents post-discharge

- Insurer reimburses eligible expenses

Claim settlement timelines vary but most insurers process claims within regulatory time limits.

Conclusion

Individual health insurance offers personalized, dedicated, and reliable medical coverage tailored to one person’s healthcare needs. It ensures complete utilization of the sum insured, stronger financial protection, and long-term medical security. With rising medical inflation and unpredictable health risks, having an individual health insurance policy is one of the smartest financial decisions you can make today.